|

Getting your Trinity Audio player ready...

|

Hello there! My name is George Aurthur, a professional content writer at topicsquest.com. Today, I’m here to help you understand something called VAT. You may be asking, what is VAT? or what is VAT tax? Well, you’re not alone. Many people have these questions. Let’s learn together in easy words.

Answer in Simple Words: VAT means “Value-Added Tax.” It is a type of tax that is added to things you buy, like clothes, toys, or even food. When you buy something, you pay a little extra money. That extra money is the VAT. It helps the government get money to build roads, schools, and hospitals. So, VAT is a tax that you pay when you buy goods and services.

What Does VAT Mean and Why Is It Important?

VAT stands for Value Added Tax. This is a kind of indirect tax that the government collects on almost every good or service. It’s different from income tax or corporate tax because you pay it only when you buy something.

VAT is important because it gives money to the government. This money is called tax revenue. Governments use this money to take care of roads, police, schools, and hospitals. Many countries like the United Kingdom, Canada, New Zealand, and many places in Europe use VAT.

Table of Contents

What Is Value Added Tax (VAT) and How Does It Work?

Value-added tax is a consumption tax. That means it is a tax on what people buy. Every time value is added to a product during the supply chain, VAT is added. For example:

- A factory makes toys and adds value.

- A shop buys the toys from the factory and adds its profit.

- A customer like you buys the toy and pays VAT.

Each stage pays VAT only on the value added at each stage.

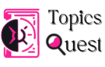

What Is the Difference Between Sales Tax and VAT?

Some people ask, “What is the difference between sales tax and VAT?” Here’s a simple answer:

- Sales Tax: You pay this tax only at the end when you buy something.

- VAT: Every time a company adds value, VAT is added. So, it happens many times.

This makes VAT more fair and useful for tax authorities and governments.

What Does VAT Tax Mean in Business?

For businesses, VAT is very important. If a business sells something, it must charge VAT and then remit VAT to the government. This is part of tax compliance.

They also get something called input VAT. This is the VAT they pay when buying raw items. Then they subtract that from what they collect. The rest is paid to the tax office.

Example:

- A shop pays $5 VAT when buying shoes.

- Then sells the shoes with $10 VAT.

- The shop pays only the difference ($10 – $5 = $5) to the government.

This is called output VAT and input tax. This helps prevent double taxation.

Who Has to Pay VAT?

Anyone who buys something usually pays VAT. But businesses that sell things must collect it. If they sell more than a certain amount, they must register for VAT. This is called VAT registration.

When they register, they get a VAT number or VAT ID. This is a special number that helps the government keep track.

What is a VAT ID and Why Is It Needed?

Many ask, “What is a VAT ID?” or “What is my VAT ID?”

A VAT ID or VAT number is a code businesses use when they do international tax or trade. This is like a name tag for taxes. It helps businesses in the European Union and outside to follow VAT rules.

It also helps when dealing with electronic invoicing and cross-border payments.

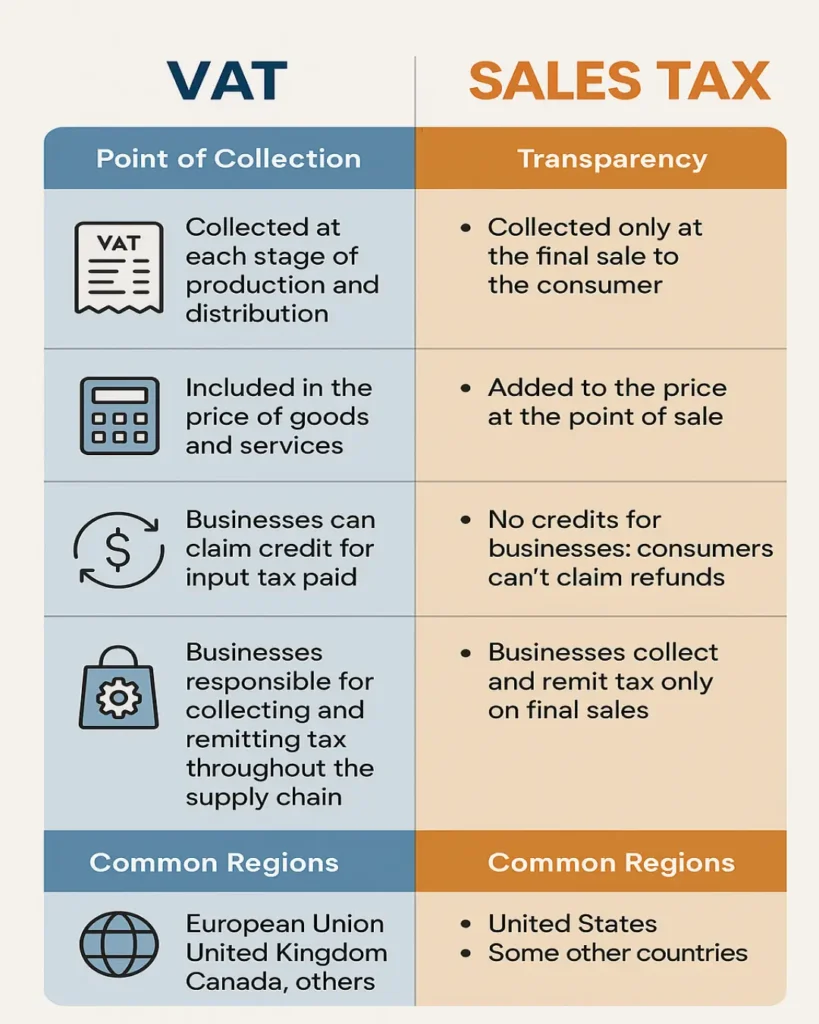

How Much Is the VAT Rate?

The VAT rate changes from country to country. Some countries use a standard VAT rate, like 20%. Others have a reduced rate like 5% for food or books.

This tax rate is added to the sales price. So if a toy costs $100 and VAT is 20%, the customer pays $120.

Try This VAT & Sales Tax Calculator

VAT & Sales Tax Calculator

Note: UK uses VAT (20% standard, 5% reduced). US uses sales tax (varies by state, typically 2%-10%).

Easily figure out how much VAT you’ll pay or get back. Just enter the amount, pick a rate, and let the calculator do the rest!

What Is a VAT Return?

A VAT return is a report that businesses send to the government. It shows how much VAT they:

- Collected (output VAT)

- Paid (input VAT)

Then they either pay the difference or get a VAT refund. This helps the government track tax compliance and avoid fraud.

What Are VAT Fees and VAT Charges?

These are just other words for the money added to your bill. When you buy something, the VAT charge or VAT fee is already included in the price.

For example:

- You see a bill: $100 + $20 VAT = $120 total

- That $20 is the VAT fee.

What Is the Reverse Charge in VAT?

Sometimes, the buyer—not the seller—must pay the VAT. This is called the reverse charge. It’s used in special cases like e-commerce, services, or when buying from another country.

This keeps the system simple and stops tax fraud.

What Is VAT Used For?

People ask, “What is the value of VAT?”

- VAT is used for building public infrastructure.

- It pays for health care, roads, schools, and pensions.

- It supports welfare spending and the budget of the European Union.

So when you pay VAT, you help your country grow!

What Is the VAT System?

The VAT system is a way of collecting indirect tax that happens many times. It is:

- Fair

- Transparent

- Easy to track

- Used in many countries like the United Kingdom, Asia, Canada, and Europe

It also supports international taxation and global trade.

VAT vs. Sales Tax: What's Better?

VAT vs. Sales tax is a common question. In many countries, VAT is better because it:

- Gives more tax revenue

- Prevents cheating

- Works well with supply and demand

Sales tax is simpler but easy to cheat. That’s why countries with a VAT often prefer it.

How Can You Get a VAT Refund?

If you’re a traveler or a business, you can ask for a VAT refund. You must show:

- Invoice

- VAT number

- Proof that goods left the country

Then, the appropriate tax is returned to you.

Final Words From George Aurthur

I believe that VAT is not something to fear. It’s a helpful way for governments to collect money fairly. When you understand it, it’s very simple.

Now you can answer questions like:

Always remember: VAT is a tax added to goods and services. It helps your country and makes sure everyone pays a fair share. Thank you for reading, and I hope you now understand “what VAT is” in a friendly and easy way!

Frequently Asked Questions

What is VAT used for in different countries?

VAT helps governments collect money to pay for public services like schools, hospitals, and roads. Each time something is sold, a little money is added as tax. That’s the VAT.

Is VAT the same in every country?

No, every country sets its own VAT rate. Some places charge a lot, and others charge a little. For example, Norway and Sweden have high VAT rates, while some countries don’t use VAT at all.

Why is VAT sometimes called a consumption tax?

Because it’s a tax you pay when you buy things, not when you earn money. It’s added when products or services are sold, so people who spend more, pay more.

What happens if a business forgets to add VAT?

If a business skips VAT by mistake, they might have to pay it later themselves. In some places, this could also lead to a fine or penalty.

Do small shops need to charge VAT?

In many countries, small shops or tiny businesses don’t have to charge VAT until they earn a certain amount of money. This amount is called a “VAT threshold.”

Can tourists get VAT refunds?

Yes! In some countries, if tourists buy things and then take them home, they can ask for a VAT refund at the airport. This is called tax-free shopping.

What is a VAT invoice?

A VAT invoice is a special receipt that shows the price of a product and how much VAT was added. It helps buyers and sellers keep track of taxes paid.

What is zero-rated VAT?

Zero-rated VAT means the item is taxed at 0%, but the seller still records it. Things like children’s clothes or books are often zero-rated in some countries.

Is there VAT on rent or housing?

That depends on the country. In some places, rent for homes is exempt from VAT, but rent for offices or business spaces may include VAT.

What are exempt goods in VAT?

Exempt goods are items that don’t have any VAT at all. This could be healthcare services, education, or financial services in many countries.